The Federal Chamber of Automotive Industries (FCAI) has released new vehicle sales statistics for May 2020, which show a continuation of the steep decline in sales witnessed in April this year.

Across the nation, 59,894 vehicles were sold during May 2020. This represents a 35.3 per cent reduction in sales when compared to the May 2019 figure of 92,561 vehicles.

The May total sales figures also represent the largest drop in May sales since VFACTS statistics began recording in 1991.

Tony Weber, chief executive of the FCAI, said the automotive market has been under pressure for some time.

“May 2020 is the 26th consecutive month of negative growth for the market, and the causative factors are well documented – droughts, floods, bushfires, tight lending conditions, unfavourable exchange rates, and political uncertainty.

“Now, we add to that the devastating effect of the COVID-19 pandemic over the past three months.

“While COVID-19 is primarily a health crisis, it has brought about an economic crisis as well. These are difficult times for the global and domestic economy, and this of course has repercussions for the local sales sector, including the automotive industry,” Mr Weber said.

Of key importance to the industry has been the topic of consumer confidence. The past few months have seen a contraction of household income and consequently household spending. This, combined with the uncertainty of the pandemic outcome, has severely curtailed retail activity.

The Reserve Bank of Australia has warned that, over the first six months of 2020, Australia is likely to experience the “biggest contraction in national output and income that we have witnessed since the Great Depression.”[1]

The Federal Government’s timely response through various stimulus initiatives has been welcomed by the FCAI, with programs such as JobSeeker and JobKeeper supporting the community. However, the Chamber has urged the Government to consider extending packages such as the Instant Asset Write Off to further encourage business investment.

“The Instant Asset Write Off initiative has real potential to help stimulate the market, and we would like to see it extended in its current form beyond 30th June 2020,” Mr Weber said.

Mr Weber noted that the combination of the stimulus initiatives and the gradual easing of the pandemic-enforced restrictions has introduced some optimism into the market.

“Anecdotally, we may be beginning to see some ‘green shoots’ in the marketplace. With people venturing out a little more, dealers have advised of a slight uptick in floor traffic through dealerships.

“Additionally, we are hearing from some brands that website traffic is on the rise – a sure sign of increased purchasing interest.

“And finally, brand End of Financial Year campaigns have started, meaning the opportunity to snare a bargain has increased significantly,” Mr Weber said.

“So if you are in the market for a new vehicle, now’s the time to visit your local dealer.”

[1] Philip Lowe, Governor, Reserve Bank of Australia, 21 April 2020.

FURTHER INFORMATION:

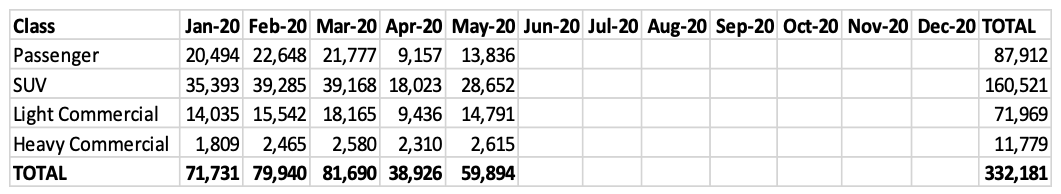

Summary by Class:

Key Points:

- The May 2020 market of 59,894 new vehicle sales is a decrease of 32,667 vehicle sales or -35.3% on May 2019 (92,561) vehicle sales. May 2020 had 25.8 selling days, compared to May 2019 with 26.80, and this resulted in a decrease of 1,132.3 vehicle sales per day.

- The Passenger Vehicle Market is down by 15,054 vehicle sales (-52.1%) over the same month last year; the Sports Utility Market is down by 12,285 vehicle sales

(-30.0%); the Light Commercial Market is down by 4,387 vehicle sales (-22.9%); and the Heavy Commercial Vehicle Market is down by 941 vehicle sales (-26.5%) versus

May 2019. - Toyota was market leader in May, followed by Mazda and Hyundai. Toyota led Mazda with a margin of 8,805 vehicle sales and 14.7 market share points.