Australia’s automotive industry delivered 82,137 vehicles during April 2023, which represents a 1.3 per cent increase on the same period in 2022.

“Electric vehicles accounted for 8 per cent of sales in April. This is well up from 1.1 per cent compared with April 2022. If you take all forms of electrification, that number has increased from 9.5 per cent to 15.4 per cent, and we know that this number would have been larger had the industry not faced global supply challenges,” FCAI Chief Executive Tony Weber said.

“It is worth noting that five out of the top ten models sold in April offer some form of electrification.”

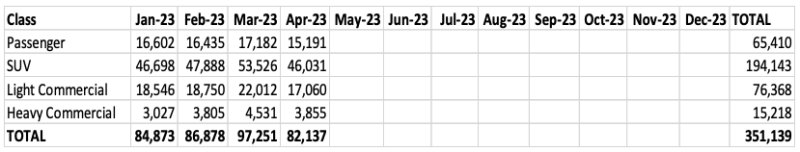

SUVs and light commercial vehicles accounted for 76.8 per cent of sales in April. Passenger vehicles accounted for 18.5 per cent, and heavy commercial 4.7 per cent.

Government and Business fleet sales increased by 8.1 per cent and 2.9 per cent respectively. Rental sales recorded a decline of 11.4 per cent.

Year to date, sales of vehicles sourced from China have increased 68.5 per cent with 13,426 vehicles sold in April. Japan remains Australia’s largest source of vehicles (22,304). Thailand is our second largest (15,886) and Korea fourth (12,952).

Sales in the ACT increased by 5 per cent compared to the same month last year, with 1,261 vehicles sold; Queensland, 4.4 per cent (18,188); Victoria, 4.2 per cent (22,226); and Western Australia, 5.2 per cent (8,303).

Sales in New South Wales decreased by 1.5 per cent (25,040); Northern Territory, 10.3 per cent (761); and Tasmania, 13.3 per cent (1,271).

Toyota led the market with 12,029 vehicles, then Mazda (6,926), Kia (6,200), Hyundai (5,732) and Ford (5,047).

The Ford Ranger was the highest selling model with 3,567 sales, followed by Toyota Hi-Lux 3,526, Toyota RAV4 (2,198), Tesla Model Y (2095) and Hyundai i30 (2,029).

VFACTS APRIL 2023

Summary by Class:

Key Points:

- The April 2023 market of 82,137 new vehicle sales is an increase of 1,072

vehicle sales or 1.3% against April 2022 (81,065). There were 22 selling days

in April 2023 compared to 23 in April 2022 and this resulted in an increase of 208.9 vehicle sales per day.

- The Passenger Vehicle Market is down by 253 vehicle sales (-1.6%) over the same month last year; the Sports Utility Market is up by 3,661 vehicle sales

(8.6%); the Light Commercial Market is down by 2,576 vehicle sales (-13.1%) and the Heavy Commercial Vehicle Market is up by 240 vehicle sales (6.6%) versus

April 2022. - Toyota was market leader in April, followed by Mazda and Kia. Toyota led Mazda with a margin of 5,103 vehicle sales and 6.2 market share points.