Australia recorded 94,993 new vehicle sales during February, a drop of 9.6 per cent on the same month last year, as consumer demand remains subdued amid cost-of-living pressures.

FCAI Chief Executive Tony Weber said that strong consumer preference for SUVs (60.4 per cent) and Light Commercial Vehicles (22.5 per cent) continued while sales in the passenger vehicle (13.5 per cent) segment declined.

However, the industry was increasingly concerned at the rate of total battery electric vehicle sales which recorded just 5.9 per cent of total sales, compared with 9.6 per cent in February 2024.

“We are now two months into the Government’s New Vehicle Efficiency Standard (NVES), and while the supply of battery electric vehicles has risen dramatically, consumer demand has fallen by 37 per cent this year compared with the first two months of 2024.

“We knew the supply of EVs would increase and there are now 88 models supplied to the Australian market. However, our grave concern has always been the rate of EV adoption and what assumptions the Government had made in its modeling around consumer demand for EVs in the NVES. This modelling remains secret.

The easy part is to set aspirational targets but without consumers demanding EVs, the NVES will not succeed. It is time for the Government to consider the realities faced by consumers,” Mr Weber said.

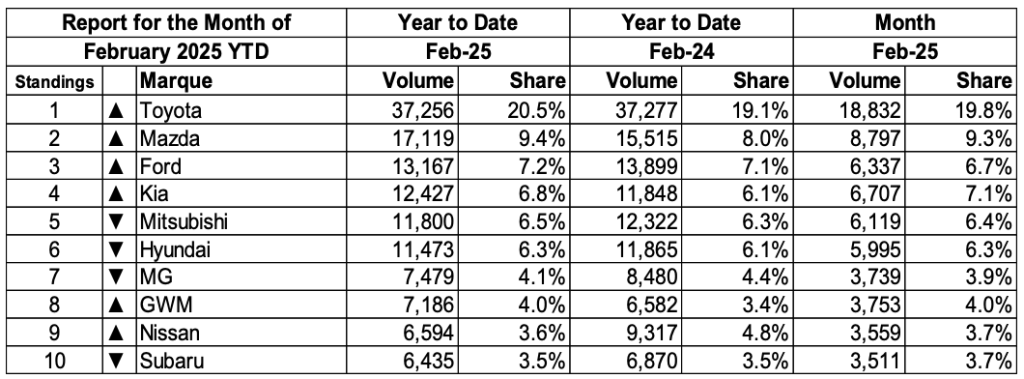

Toyota was the market leader with sales of 18,832 during February, followed by Mazda (8,797), Kia (6,707), Ford (6,337) and Mitsubishi (6,119).

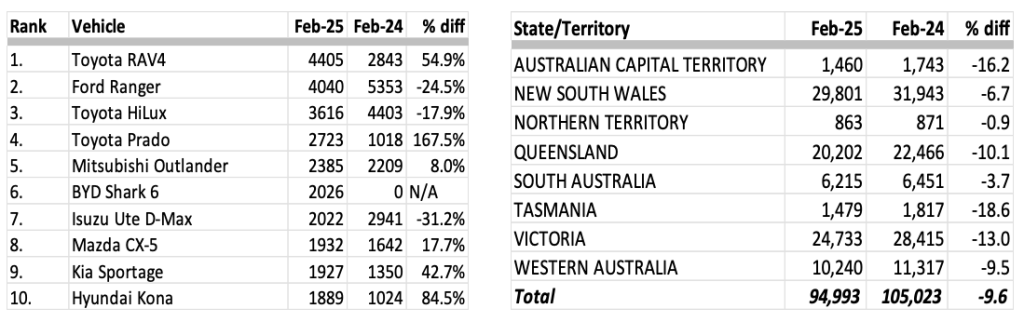

The Toyota RAV4 was Australia’s top selling vehicle with sales of 4,405 followed by the Ford Ranger (4,040), Toyota HiLux (3,616), Toyota Prado (2,723) and the Mitsubishi Outlander (2,385).

For February 2025, sales in the Australian Capital Territory were down 16.2 per cent on February 2024 to 1,460; New South Wales was down 6.7 per cent to 29,801; Northern Territory decreased by 0.9 per cent to 863; Queensland fell 10.1 per cent to 20,202; South Australia also decreased by 3.7 per cent to 6,215; Tasmania had a decrease of 18.6 per cent to 1,479; Victoria was down 13.0 per cent to 24,733 and Western Australia decreased 9.5 per cent to 10,240.

VFACTS FEBRUARY 2025

Summary by Class:

Key Points:

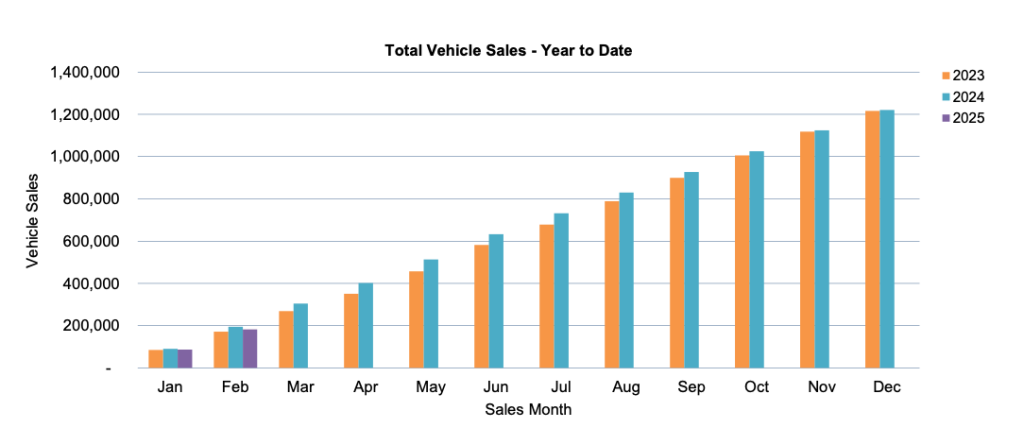

- The February 2025 market of 94,993 shows a decrease in new vehicle sales of 10,030 (-9.6%) compared to February 2024 (105.023). There were 24 selling days in February 2025 and 25 in February 2024 resulting in a decrease of 242.9 vehicle sales per day in February 2025.

- The Passenger Vehicle Market is down by 6,823 vehicle sales (-34.8%) over the same month last year; the Sports Utility Market is down by 352 vehicle sales (-0.6%); the Light Commercial Market is down by 2,432 vehicle sales (-10.2%) and the Heavy Commercial Vehicle Market is down by 423 vehicle sales (-10.9%) versus February 2024.

- Toyota was market leader in February, followed by Mazda and Ford. Toyota led Mazda with a margin of 10,035 vehicle sales and 10.5 market share points.

SALES RESULTS:

Top 10 Models (by sales volume): State/Territory results (by sales volume):

Total Vehicle Sales – Year to Date:

VFACTS monthly vehicle sales data is available on the third working day after the end of every month.