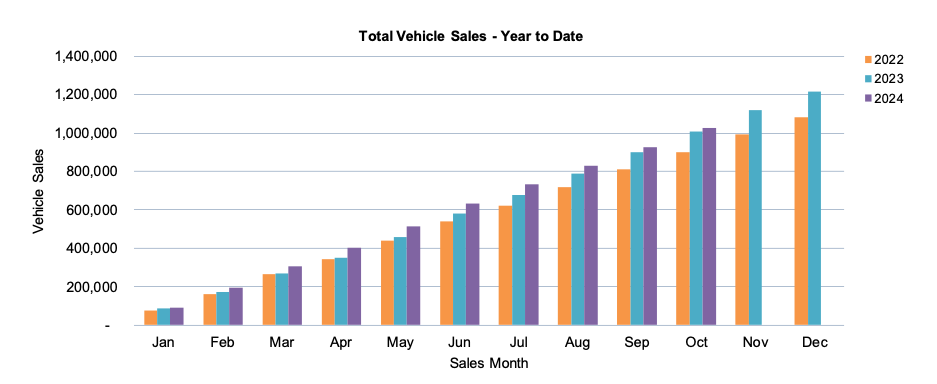

Australia recorded 98,375 new vehicle sales in October 2024 taking sales beyond one million for the year to date but also showing that growth is easing in the last quarter.

The October result is 7.9 per cent down on the same month last year and continues the easing of the market during the second half of 2024. However, it is the second-best October result on record and brings the year-to-date sales total to 1,025,621.

“While not at the record levels of 2023, the October result is solid,” Mr Weber said. However, we remain concerned about the continuing performance of the private buyers segment which was down 14.2 per cent this month following a reduction of 17.2 per cent in September. This does indicate that economic pressures are a concern for families across the country.”

Mr Weber added that the battery electric vehicle share of new sales has remained subdued despite an increasing number of new brands entering the market and substantial tax benefits available to some purchasers through the FBT concession.

“Many of these new EV sales are in the highly competitive medium passenger segment which already records almost fifty per cent of sales being electric but the segment accounting for just over four per cent of total sales.

“Conversely, we are now witnessing the introduction of new plug-in hybrid models in the SUV and Light Commercial segments which have previously been dominated by petrol and diesel models. This is significant given the overwhelming popularity of SUVs and Light Commercial vehicles in Australia.

“This activity across segments and models highlights the competitiveness of our market and the increasing choice available to consumers across vehicle and fuel types. It will be interesting to see how this translates to an increase in sales momentum in the run up to the end of year result in December.

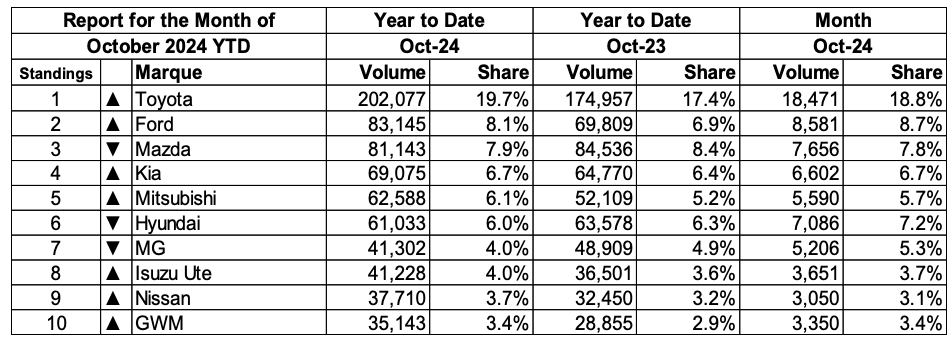

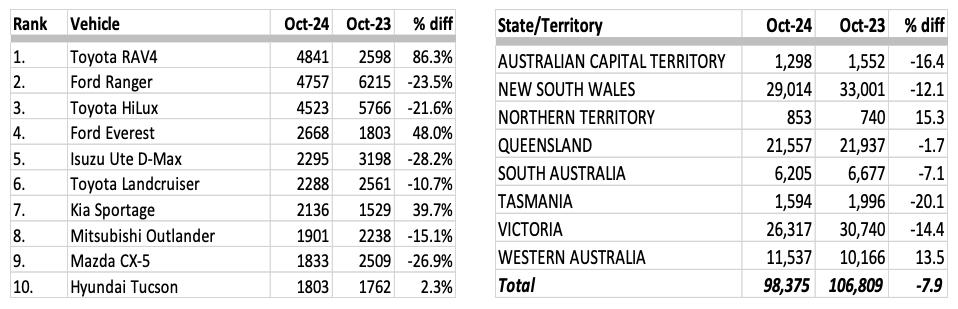

Toyota was the market leader with sales of 18,471 in October, followed by Ford (8,581), Mazda (7,656), Hyundai (7,086) and Kia (6,602). The Toyota RAV4 was Australia’s top selling vehicle with sales of 4,841 followed by Ford Ranger (4,757), Toyota HiLux (4,523), Ford Everest (2,668) and Isuzu Ute D-Max (2,295).

Sales in the Australian Capital Territory were down 16.4 per cent on October 2023 to 1,298; New South Wales was down 12.1 per cent to 29,014; Northern Territory was up 15.3 per cent to 853; Queensland decreased 1.7 per cent to 21,557; South Australia also decreased by 7.1 per cent to 6,205; Tasmania had a decrease of 20.1 per cent to 1,594; Victoria decreased 14.4 per cent to 26,317 and Western Australia increased by 13.5 to 11,537.

VFACTS OCTOBER 2024

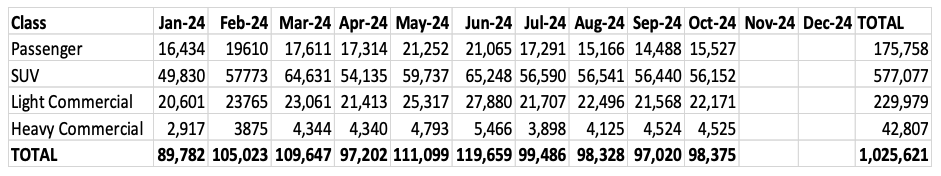

Summary by Class:

Key Points:

- The October 2024 market of 98,375 shows a decrease in new vehicle sales of 8,434 (-7.9%) compared to October 2023 (106,809). There were 26.4 selling days in October 2024 compared to 25.2 in October 2023 which resulted in a decrease of 512.1 vehicle sales per day in October 2024.

- The Passenger Vehicle Market is down by 2,089 vehicle sales (-11.9%) over the same month last year; the Sports Utility Market is down by 3,107 vehicle sales (-5.2%); the Light Commercial Market is down by 3,510 vehicle sales (-13.7%) and the Heavy Commercial Vehicle Market is up by 272 vehicle sales (6.4%) versus October 2023.

- Toyota was market leader in October, followed by Ford and Mazda. Toyota led Ford with a margin of 9,890 vehicle sales and 10.1 market share points.

SALES RESULTS:

Top 10 individual models (by sales volume): State/Territory results (by sales volume):

Total Vehicle Sales – Year to Date:

VFACTS monthly vehicle sales data is available on the third working day after the end of every month.