New vehicle sales in the Australian market for the month of April 2020 were today announced by Tony Weber, chief executive of the Federal Chamber of Automotive Industries (FCAI).

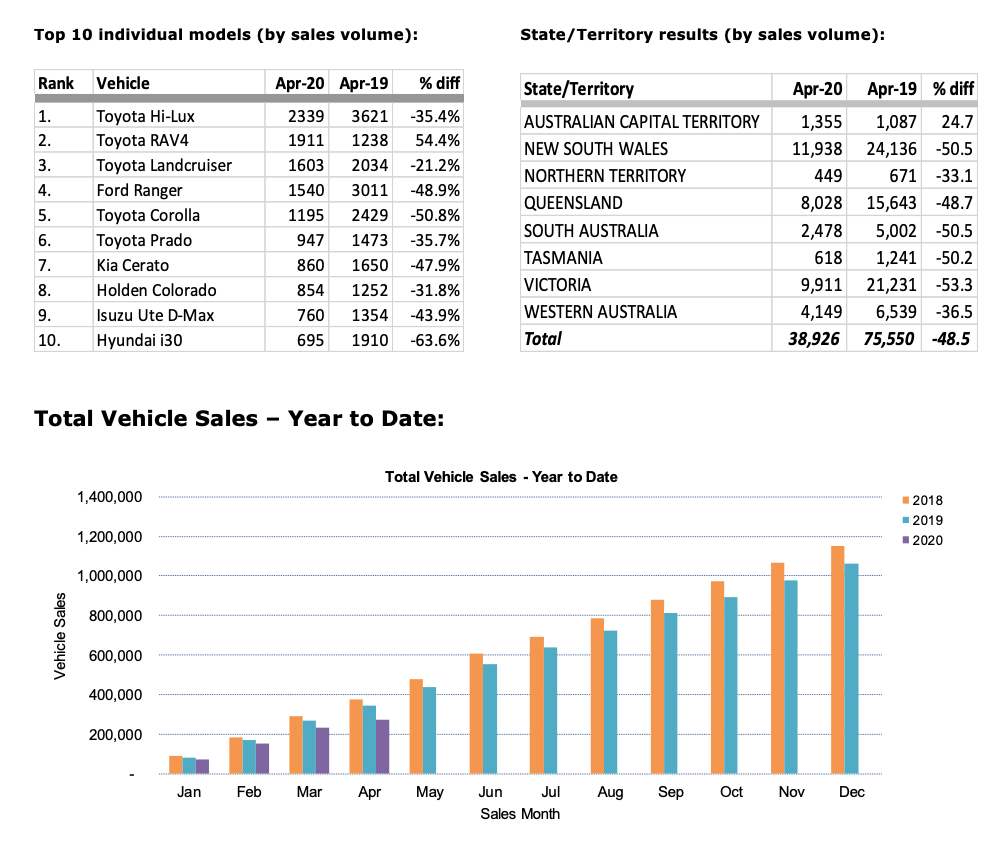

“A total of 38,926 sales were recorded for the month. This figure represents a fall of 48.5 per cent over the same period last year (75,550 sales), and the largest single decrease of any month since VFACTs figures were first recorded in 1991.

Year to date figures for April totalled 272,287 sales, down from 344,088 in 2019, which equates to a 20.9 per cent decline.

“Clearly, the COVID-19 pandemic has had a major influence on the April sales result, and reflects a downturn in the broader economy right across the country,” Mr Weber said.

“Figures recently released by the Australian Bureau of Statistics[1] show that 31 per cent of Australian citizens have experienced a decrease in income due to the pandemic,” Mr Weber said.

“In addition[2] 72 per cent of Australian businesses reported that reduced cash flow is expected to have an adverse impact on business over the next two months.

“These conditions inevitably impact consumer confidence and purchase decisions.”

The Australian new vehicle market has been under stress for some time, with April 2020 representing the 25th consecutive month of declining sales on a year-on-year basis (for example April 2020 compared to April 2019). Environmental, economic and political factors, along with tight credit lending restrictions, have all contributed to this fall.

According to Mr Weber, the automotive industry in Australia has focused on keeping dealerships open to ensure customers can access sales and important maintenance services for their vehicles, despite the current health and economic difficulties.

“Our member brands are working closely with their dealer networks to ensure dealerships are accessible and safe. Enhanced hygiene protocols and contact-less sales and social interactions have been initiated to ensure personal protection for both customers and dealer staff.

Many automotive brands are also providing financial and sales target relief to stressed retail outlets.

“We know that our member brands are doing everything they can to assist both their dealerships and their valued customers during this difficult time.

“But more needs to be done. We are calling on Federal and State Governments to consider the automotive industry, which employs over 65,000 people in Australia, when compiling their recovery plans,” Mr Weber said.

“The JobKeeper and JobSeeker payment programs put in place by the Federal Government are a welcome initiative.

“However, we believe the scope needs to ensure high turnover and low margin businesses, such as new car dealerships, are covered.

“These businesses are often the backbone of local communities and in the current environment, many are facing overwhelming challenges.

“As well as continued business initiatives, support to bolster consumer confidence is imperative to the strength of our economy.

“We have begun to see a slight lift in consumer confidence[3] as the COVID-19 restrictions start to ease. We really need further measures to support this confidence and continue the positive trend.

“Initially, we would ask that the instant asset write off package is extended to further stimulate business purchasing,” Mr Weber said.

[1] ABS Household Impacts of COVID-19 Survey published 01/05/2020

[2] ABS Business Indicators, Business Impact of COVID-19 published 04/05/2020

[3] Source ANZ/Roy Morgan 01/05/2020

FURTHER INFORMATION:

Summary by Class:

Key Points:

- The April 2020 market of 38,926 new vehicle sales is a decrease of 36,624 vehicle sales or -48.5% on April 2019 (75,550) vehicle sales. April 2020 had 23.9 selling days compared to April 2019 with 23.0, but this resulted in a decrease of 1656.1 vehicle sales per day.

- The Passenger Vehicle Market is down by 14,659 vehicle sales (-61.6%) over the same month last year; the Sports Utility Market is down by 15,167 vehicle sales

(-45.7%); the Light Commercial Market is down by 6,165 vehicle sales (-39.5%); and the Heavy Commercial Vehicle Market is down by 633 vehicle sales (-21.5%) versus

April 2019. - Toyota was market leader in April, followed by Mazda and Kia. Toyota led Mazda with a margin of 7,303 vehicle sales and 18.7 market share points.

SALES RESULTS

Source: VFACTS

VFACTS monthly vehicle sales data is available at noon on the third working day after the end of every month.